texas auto sales tax

Motor Vehicle Sales Tax. Motor Vehicle Local Sports and Community Venue District Tax for Short-Term Rentals.

Texas Car Sales Tax Everything You Need To Know

There is a 625 sales tax on used vehicle sales in Texas.

. You can find these fees further down on. In most counties in Texas the title fee is around 33. Estimate Tax Calculation For Buying A Used Motor Vehicle.

Vehicle purchases are among the largest current sales in Texas which means they can result in a high sales tax bill. Tax is calculated on the leasing companys purchase price. In addition to taxes car purchases in Texas may be subject to other fees like registration title and plate fees.

Using our Lease Calculator we find the monthly payment 59600. If you buy from a private party such as a friend or relative the tax is 625 of. Auto sales tax and the cost of a new car tag are major factors in any tax title and license calculator.

In another state for the same vehicle same price and same tax. Add this to the Dallas MTA tax at 01 and the state sales tax of 0625 combined together give you a tax rate of 0825. An example of items that are exempt from Texas sales tax are items specifically purchased for resale.

The sales tax on both new and used vehicles is calculated by multiplying the cost of the vehicle by 625 percentage. You are going to pay 206250 in taxes on this vehicle. Texas has recent rate changes Thu Jul 01 2021.

The title application must be accompanied by Affidavit of Motor Vehicle Gift Transfer Texas Comptroller of Public Accounts Form 14-317. Local taxing jurisdictions cities counties special purpose districts and transit authorities can also impose up to 2 percent sales. Texas has a statewide sales tax of 625 that applies to all car sales.

Texas collects a 625 state sales tax rate on the purchase of all vehicles. Motor vehicle sales tax is due on each retail sale of a motor vehicle in Texas. With local taxes the total sales tax rate is between 6250 and 8250.

Texas has a 625 statewide sales tax rate but also has 981 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 1681 on top. Our experienced sales and service staff is. The sales tax on a vehicle purchased in Texas is 625.

Tax is imposed on the leasing companys Texas purchase of a motor vehicle and is due at the time of titling and registration. In the state of Texas sales tax is legally required to be collected from all tangible physical products being sold to a consumer. The Texas Comptroller states that payment of motor vehicle sales.

Local and county taxes are also applied to car sales and add about another 167 to the price of your purchase. No tax is due on the lease payments made by the lessee. Visit us today at our South location 16200 Hwy 3 Webster TX 77598 or our North locaton- 11655 North Fwy Houston TX 77060-our seasoned professionals are ready to answer any questions you may have.

Do I have to pay sales tax on a used car in Texas. Texans who buy a used vehicle from anyone other than a licensed vehicle dealer are required to pay motor vehicle sales tax of 625 percent on the purchase price or standard presumptive value SPV whichever is the highest value. This means that an individual in the state of Texas purchases school supplies and books for their children would.

However if you bought a car from a private party then the sales tax is calculated from the standard presumptive value SPV or purchase price whichever is higher. Some dealerships may charge a documentary fee of 125 dollars. For leased or leased vehicles see Taxation of leasing and rentals.

The Texas state sales tax rate is 625 and the average TX sales tax after local surtaxes is 805. A motor vehicle sale includes installment and credit sales and exchanges for property services or money. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

Groceries prescription drugs and non-prescription drugs are exempt from the Texas sales tax. SPV applies wherever you buy the vehicle in Texas or out of state. For additional information see our Call Tips and Peak Schedule webpage.

Some states provide official vehicle registration fee calculators while others provide lists of their tax tag and title fees. How much tax is due. If buying from an individual a motor vehicle sales tax 625 percent on either the purchase price or standard presumptive value whichever is the highest value must be paid when the vehicle is titled.

The dealer will remit the tax to the county tax assessor-collector. The leasing company may use the fair market value deduction to reduce the vehicles taxable value. Motor Vehicle Texas Emissions Reduction Plan.

A vehicles SPV is its worth based on similar. The tax is a debt of the purchaser until paid to the dealer. Counties and cities can charge an additional local sales tax of up to 2 for a maximum possible combined sales tax of 825.

Imagine that your monthly lease payment is 500 and your states sales tax on a leased car is 6. Texas Auto strives to provide the best vehicles and service possible to the dealership area. Select the Texas city from the list of popular cities below to see its current sales tax rate.

Texas has 2176 special sales tax jurisdictions with local. A transfer of a motor vehicle without payment of consideration that does not qualify as a gift is a retail sale and is subject to the. The sales price if you paid 80 or more of the vehicles standard presumptive value SPV.

Motor Vehicle Gross Rental Receipts Tax. After you enter those into the blanks you will get the Dallas City Tax which is 01. Find your state below to determine the total cost of your new car including the car tax.

The sales tax for cars in Texas is 625 of the final sales price. If you are buying a car for 2500000 multiply by 1 and then multiply by 0825. If you buy the vehicle from a licensed dealer the tax is 625 of the sales price.

Sales tax for a leased vehicle is calculated based on the states tax percentage and the cost of the lease payments. The dealer will collect motor vehicle sales tax from the purchaser when a motor vehicle is purchased from a dealer in Texas if the motor vehicle has a gross weight of 11000 pounds or less. 1 for diesel vehicles in 1997 and newer vehicles over.

This page covers the most important aspects of Texas sales tax related to the purchase of vehicles. Our Texas lease customer must pay full sales tax of 1875 added to the 30000 cost of his vehicle. Motor Vehicle Sales and Use Tax.

In Texas the value of your trade-in vehicle is not subject. Texas imposes a 625 percent state sales and use tax on all retail sales leases and rentals of most goods as well as taxable services. For instance if you purchase a car for 20000 you will pay a sales tax of 1250 which is.

Motor Vehicle Seller-Financed Sales Tax. The state sales tax rate in Texas is 6250. 500 X 06 30 which is what you must pay in sales tax each month.

If youre buying a car in Texas you can expect the car sales tax to be about 7928 on average.

Car Sales Tax In Nevada Getjerry Com

Texas Sales Tax Guide And Calculator 2022 Taxjar

What S The Car Sales Tax In Each State Find The Best Car Price

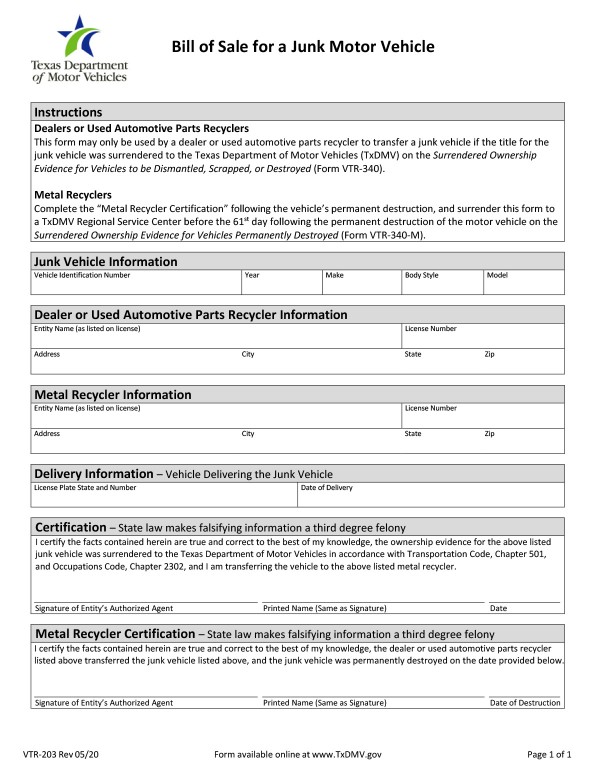

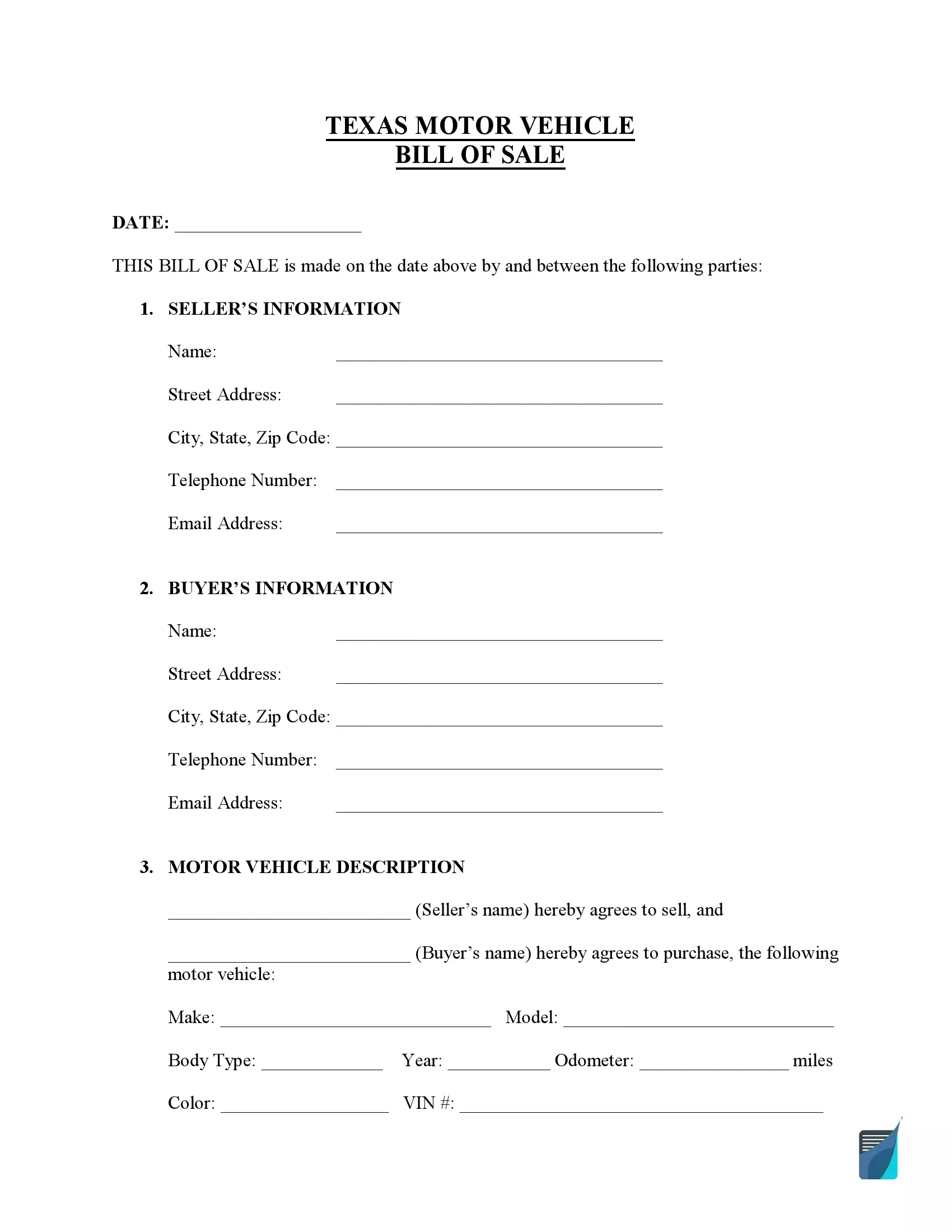

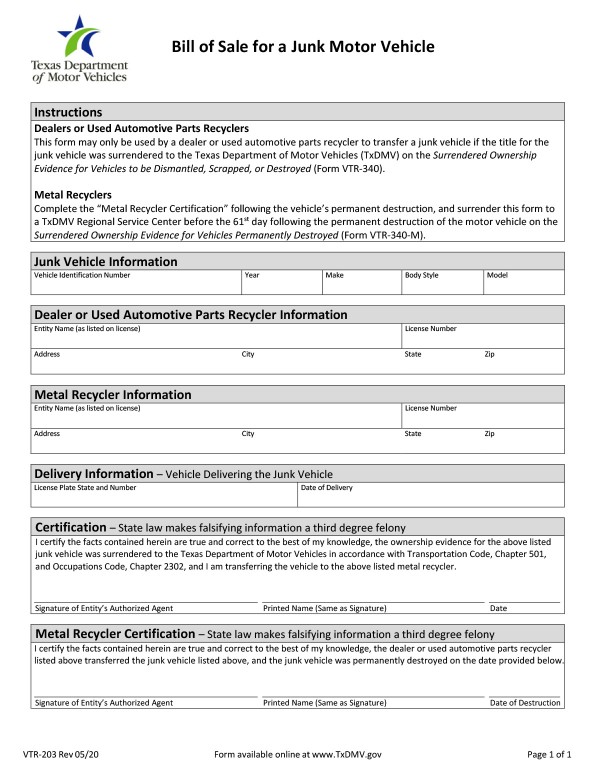

Free Texas Dmv Bill Of Sale Form For Motor Vehicle Trailer Or Boat Pdf

Texas Sales Tax Small Business Guide Truic

Bill Of Sale Texas Fill Online Printable Fillable Blank Pdffiller

How To Gift A Car In Texas 500 Below Cars

Free Texas Vehicle Bill Of Sale Form Pdf Formspal

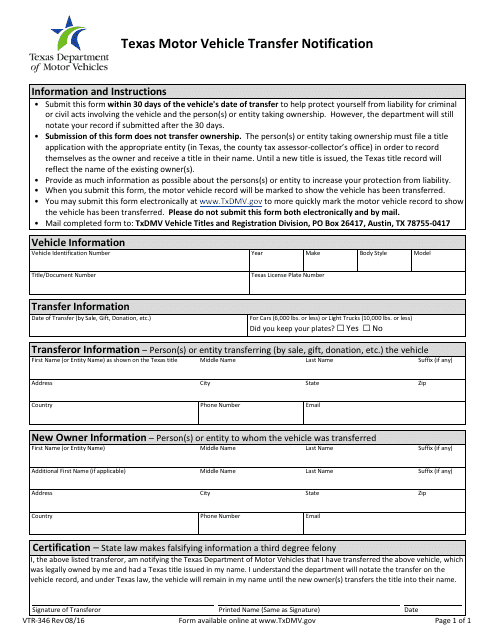

Form Vtr 346 Download Fillable Pdf Or Fill Online Texas Motor Vehicle Transfer Notification Texas Templateroller

Texas Bill Of Sale Form Templates For Car Boat Fill Out And Download

What S The Car Sales Tax In Each State Find The Best Car Price

Free Fillable Texas Vehicle Bill Of Sale Form Pdf Templates

Texas Used Car Sales Tax And Fees

How To Calculate Sales Tax How To Find Out How Much Sales Tax Sales Tax Calculation Youtube

States With Highest And Lowest Sales Tax Rates

What S The Car Sales Tax In Each State Find The Best Car Price